This weekend, the price of Bitcoin (BTC) crossed the symbolic threshold of $40,000, reaching $40,846 at the end of the day on Sunday. This is its highest level since April 28, 2022. Carried by a wind of optimism, the flagship cryptocurrency is beginning its return to the heights after more than a year of storm.

An increase that rewards resilient investors

After a nightmarish 2022 which saw it lose up to 70% of its value between November 2021 and June 2022, Bitcoin ends 2023 with a bang.

This performance rewards the patience and resilience of long-term investors, who held on despite an unfavorable macroeconomic context (rapid inflation, restrictive monetary policies, risk of recession). Some analysts also see it as a tangible sign of ever-wider adoption of cryptos by the general public and institutions.

Over the whole year, BTC posted an increase of 140% against the greenback. Above all, in just one month, its value jumped by almost 50% thanks to a wave of euphoria.

The specter of a Bitcoin ETF hovering over the USA

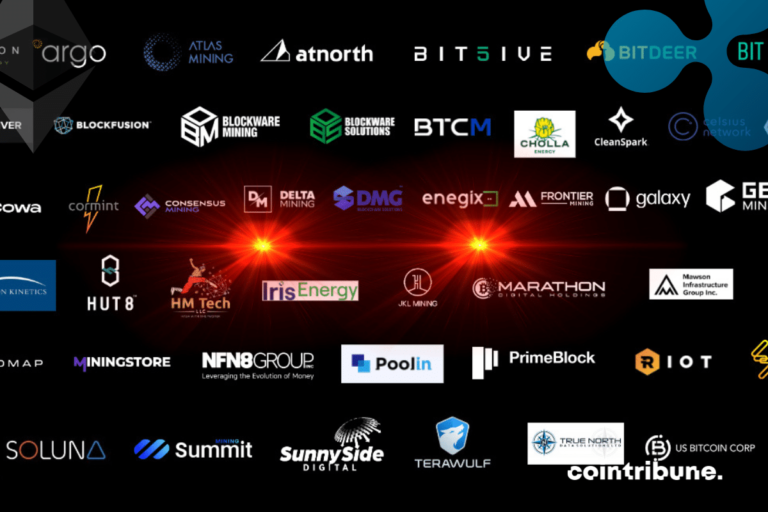

The other catalyst behind this spectacular spring rally would be the upcoming approval of a spot Bitcoin ETF (exchange traded fund) in the United States. No less than 13 firms have filed a request to this effect with the American stock market watchdog, the SEC.

Among the applicants, we find the asset management juggernaut BlackRock and Grayscale. According to Bloomberg ETF, the chances are 90% that these ETFs will all be approved by January 10, 2024.

The Standard Chartered bank even estimates that Bitcoin could cross the mythical milestone of $100,000 by the end of 2024, driven by the “introduction earlier than expected” of these famous index funds.

Recently, the move above $40,000 led to a nasty purge among short sellers, with $78 million in short positions liquidated in a matter of hours.

Now all eyes are on the $50,000 threshold. According to the analysis of Santimentthis milestone could be reached as early as January 2024 if the confirmation of the ETFs gave an additional boost to the market.

In any case, the end of the year promises to be exciting with heightened hopes and persistent fears (FOMO and FUD). And the upcoming approval of Bitcoin ETFs across the Atlantic could serve as a springboard to new records. The goal of $100,000 by 2024 has never seemed so within reach for the crypto star. Bitcoin’s comeback may only be beginning.

Maximize your Tremplin.io experience with our ‘Read to Earn’ program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.